Introduction

Cryptocurrencies have revolutionized the financial landscape since the introduction of Bitcoin in 2009. Crypto companies, ranging from exchanges and wallet providers to blockchain developers and DeFi platforms, have played a pivotal role in this transformation. This script delves into the history, key players, innovations, challenges, and future prospects of these companies.

History of Crypto Companies

Early Beginnings

The inception of crypto companies can be traced back to the launch of Bitcoin by the pseudonymous Satoshi Nakamoto. In 2010, the first Bitcoin exchange, BitcoinMarket.com, was established, enabling users to trade Bitcoin for fiat currency. This marked the beginning of a new financial ecosystem.

Expansion and Growth

The years following Bitcoin’s introduction saw the emergence of numerous cryptocurrencies and companies. Ethereum, launched in 2015 by Vitalik Buterin, introduced smart contracts, allowing for decentralized applications (dApps). This innovation spurred the growth of companies focused on developing blockchain-based solutions.

ICO Boom and Bust

In 2017, Initial Coin Offerings (ICOs) became a popular method for startups to raise funds. Companies like Ethereum raised substantial amounts, but the lack of regulation led to numerous scams and failures, culminating in a market crash in 2018. Despite this, the period demonstrated the potential for crypto companies to disrupt traditional fundraising methods.

Key Players in the Crypto Industry

Exchanges

- Binance: Founded in 2017 by Changpeng Zhao, Binance quickly grew to become the largest cryptocurrency exchange by trading volume. It offers a wide range of services, including trading, staking, and lending.

- Coinbase: Established in 2012, Coinbase is one of the most trusted and user-friendly platforms, especially for beginners. It became the first major crypto company to go public in 2021.

Wallet Providers

- Ledger: A leader in hardware wallets, Ledger provides secure storage solutions for cryptocurrencies, protecting users from hacks and theft.

- MetaMask: A popular Ethereum wallet and browser extension, MetaMask enables users to interact with dApps directly from their web browsers.

Blockchain Developers

- Consensys: Founded by Ethereum co-founder Joseph Lubin, Consensys focuses on building infrastructure and applications on the Ethereum blockchain.

- Hyperledger: An open-source collaborative effort hosted by the Linux Foundation, Hyperledger aims to advance cross-industry blockchain technologies.

DeFi Platforms

- MakerDAO: A pioneer in decentralized finance (DeFi), MakerDAO allows users to generate the stablecoin DAI by locking up collateral in smart contracts.

- Uniswap: A decentralized exchange (DEX) that utilizes an automated market maker (AMM) model, Uniswap facilitates trading without the need for intermediaries.

Innovations Driven by Crypto Companies

Smart Contracts

Smart contracts, self-executing contracts with the terms directly written into code, have revolutionized the way transactions are conducted. Ethereum was the first platform to introduce smart contracts, enabling a wide range of applications from decentralized finance to supply chain management.

Decentralized Finance (DeFi)

DeFi platforms have democratized access to financial services. By eliminating intermediaries, DeFi allows for peer-to-peer lending, borrowing, and trading. This sector has seen explosive growth, with companies like Aave, Compound, and Synthetix leading the charge.

Non-Fungible Tokens (NFTs)

NFTs represent ownership of unique digital assets, such as art, music, and virtual real estate. Companies like OpenSea and Rarible have created marketplaces for NFTs, enabling artists and creators to monetize their work in novel ways.

Layer 2 Solutions

To address scalability issues, Layer 2 solutions like Lightning Network for Bitcoin and Optimistic Rollups for Ethereum have been developed. These technologies allow for faster and cheaper transactions, enhancing the usability of blockchain networks.

Challenges Faced by Crypto Companies

Regulatory Uncertainty

Regulatory frameworks for cryptocurrencies vary widely across countries, creating a complex and uncertain environment for crypto companies. Issues such as compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations remain challenging.

Security Concerns

Crypto companies are prime targets for cyberattacks. Hacks and security breaches can result in significant financial losses and damage to reputations. Ensuring the security of user funds and data is a critical concern for these companies.

Market Volatility

The cryptocurrency market is notoriously volatile, with prices subject to rapid and unpredictable changes. This volatility can impact the stability and profitability of crypto companies, as well as investor confidence.

Scalability Issues

As the popularity of blockchain grows, so does the strain on its networks. Scalability issues, such as slow transaction speeds and high fees, present significant hurdles. Companies are continually working on solutions to improve scalability without compromising security.

Future Prospects of Crypto Companies

Mainstream Adoption

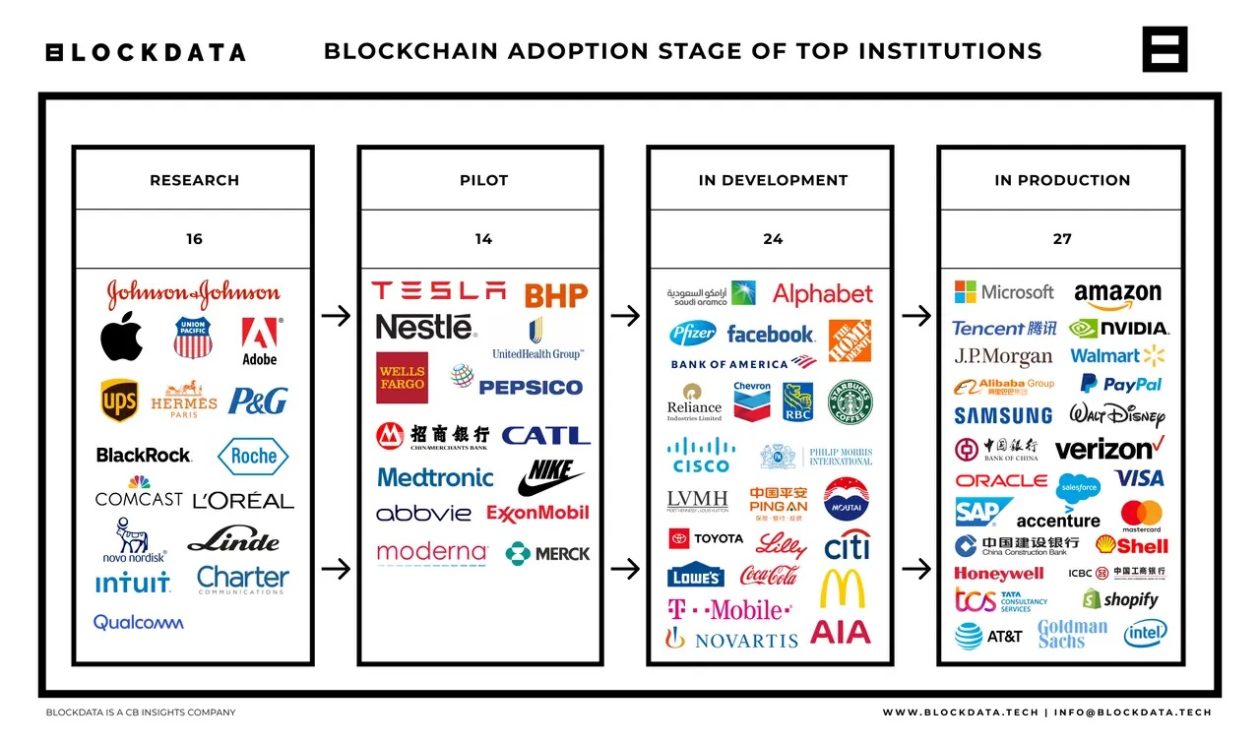

The integration of cryptocurrencies into mainstream finance is becoming increasingly evident. Major financial institutions, such as PayPal and Visa, have begun offering crypto-related services. The adoption of Bitcoin as legal tender by countries like El Salvador highlights the growing acceptance of cryptocurrencies.

Central Bank Digital Currencies (CBDCs)

Central banks around the world are exploring the development of their own digital currencies. While these CBDCs differ from decentralized cryptocurrencies, they indicate a shift towards digital finance. Crypto companies are likely to play a role in the infrastructure and technology supporting these initiatives.

Institutional Investment

Institutional investors are increasingly entering the crypto space, bringing significant capital and legitimacy. Companies like Grayscale and MicroStrategy have made substantial investments in Bitcoin, signaling confidence in the long-term value of cryptocurrencies.

Technological Advancements

Continued innovation in blockchain technology will drive the future of crypto companies. Developments in areas such as interoperability, privacy, and governance are expected to enhance the functionality and appeal of blockchain-based solutions.

Conclusion

Crypto companies have come a long way since the early days of Bitcoin. They have introduced groundbreaking innovations, faced significant challenges, and are poised to shape the future of finance. As the industry continues to evolve, these companies will play a crucial role in driving the adoption and integration of cryptocurrencies into everyday life.